2025 Crypto Basis Rules: How to Minimize Capital Gains

The IRS has drastically changed how crypto cost basis is calculated for 2025 and forward. Since basis is now calculated on a wallet-by-wallet approach, taxpayers

Stop worrying about your crypto taxes or business finances and get back to doing what you do best.

You don't want just any CPA. You want THE Crypto Tax CPA!

"Micah is definitely somebody you can count on to do what he says (and more). I recommend him to everybody I know."

WE'VE BEEN FEATURED IN

Get expert advice from a CPA who is highly experienced in cryptocurrency taxation. Our team can help you assess your current tax situation, navigate complicated crypto issues, and identify tax reduction strategies.

Clueless on how to keep track of your crypto transactions?

No idea what has to be reported and what is not?

Most people don’t! We can guide you through what is required and take the stress out of your crypto accounting.

Get expert advice from a CPA who is highly experienced in cryptocurrency taxation. Our team can help you assess your current tax situation, navigate complicated crypto issues, and identify tax reduction strategies.

Our entire focus is online – blockchain and also internet based businesses. If you’ve got a tax or accounting issue related to something digital, we can assist.

We specialize in tax compliance for crypto investors. We were one of the first firms to offer cryptocurrency tax preparation. Whether you are a casual investor, a day trader, a miner, or have a crypto-related business, we have done it all.

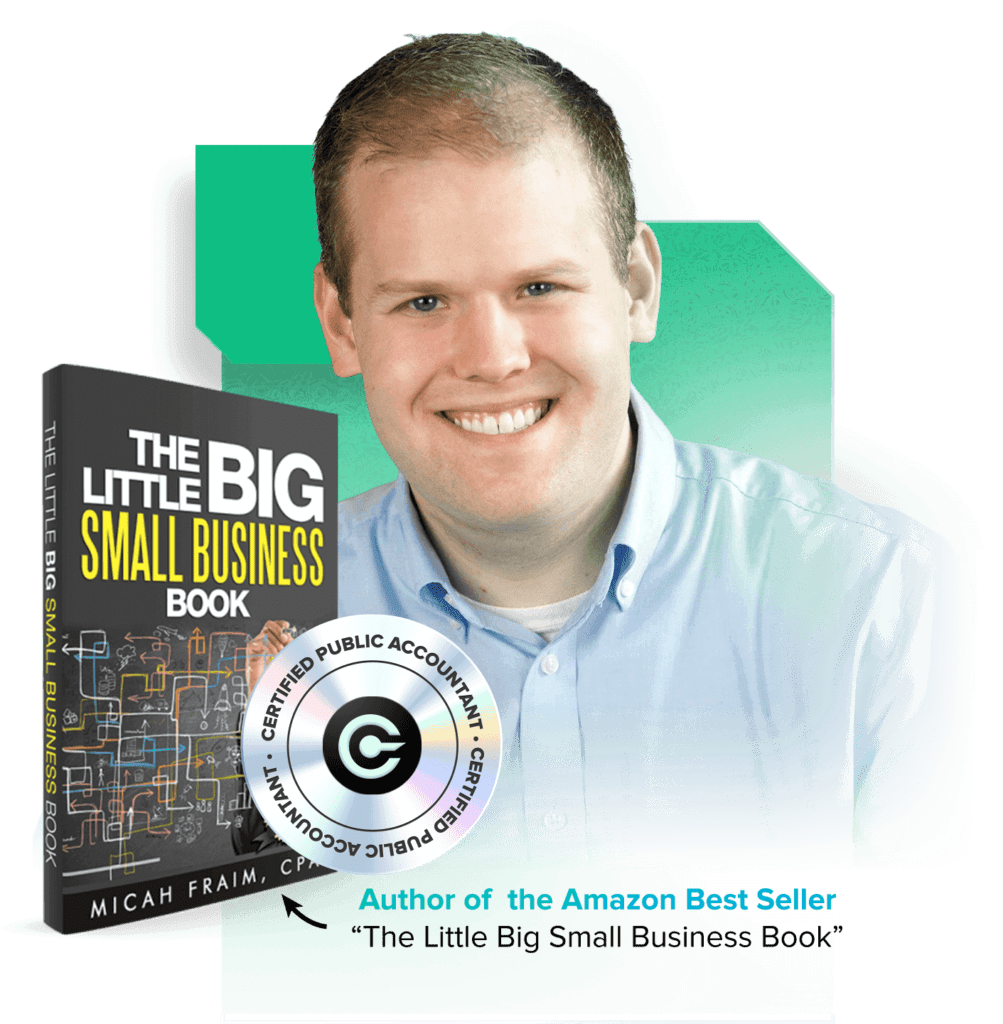

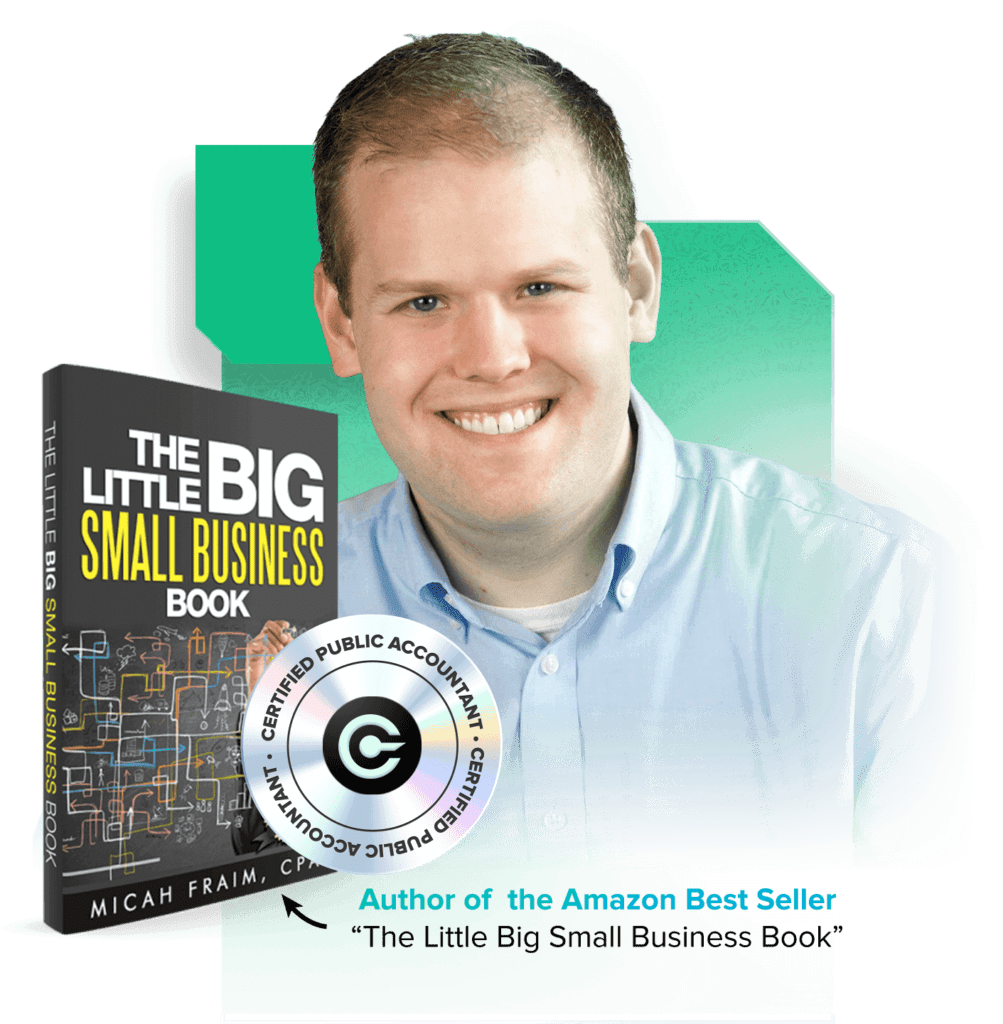

Hi! I’m Micah and I am a CPA and cryptocurrency tax expert. Blockchain is an emerging market and moves at lightning speed. Because of this, very few people – including most CPAs – understand how it is taxed. But I LOVE crypto and am involved in it daily – both as an investor and an accountant. We can help you to understand how crypto is taxed. And more importantly, we’ll help you reduce the taxes you’ll pay on your income.

We focus on tax planning and preparation for cryptocurrency investors, online businesses, and other growth-centric businesses. If you have a dynamic and rapidly changing situation, that’s what we love and what we’re here for.

Rules for cryptocurrency and other digital assets are rapidly changing and confusing. And as such end up being a big source of stress for many investors. They do not understand the rules surrounding crypto taxation. And what they do learn may be outdated within a few months.

And worst yet, not understanding those rules can get you in major trouble with the IRS and cost you A LOT of money

We’re here to take the stress out of your taxes and finances and in doing so MAKE YOU MORE MONEY!

Are you wondering if you really need to pay Bitcoin taxes or other cryptocurrency taxes, especially if you only made a very small profit? We can assure you: it’s better to be safe than sorry! The IRS is ramping up reporting requirements across the board, increasing the chances of audits and automated flagging if you do not report your crypto transactions. The IRS has made it clear that it is serious about crypto tax. We can help you make sure you’re complaint all while minimizing your tax bill.

In the simplest terms, if you sold Bitcoin, it is now considered a capital gain or loss. If you sold the Bitcoin for a profit, it is a capital gain. In this case, you will likely owe the government money. If you sold the Bitcoin at a loss, it is a capital loss. In this case, you will be eligible for a deduction.

This may be the only scenario where you do not need to report your purchase with the IRS. If you purchased Bitcoin and then maintained that holding, you will not owe Bitcoin taxes on the transaction or the currency itself.

The exact tax status of the payment will influence the forms you need to file. If you paid an established employee, this falls under the scope of a W-2. On the other hand, if your business employed a contractor and paid in cryptocurrency, you must issue a 1099.

Unsurprisingly, you must report this on your return. According to current crypto tax regulations, you are obligated to treat your crypto income exactly as you would with regular income. As with fiat currency, your federal tax rate will then vary based upon income bracket.

As the gifter of cryptocurrency, gift tax rules apply and gift tax returns may need to be filed. Significant tax planning opportunities exist around gifting cryptocurrency.

As the donor of cryptocurrency, you may be eligible for a tax deduction due to your charitable giving of donations.

In the simplest terms, if you sold Bitcoin, it is now considered a capital gain or loss. If you sold the Bitcoin for a profit, it is a capital gain. In this case, you will likely owe the government money. If you sold the Bitcoin at a loss, it is a capital loss. In this case, you will be eligible for a deduction.

This may be the only scenario where you do not need to report your purchase with the IRS. If you purchased Bitcoin and then maintained that holding, you will not owe Bitcoin taxes on the transaction or the currency itself.

The exact tax status of the payment will influence the forms you need to file. If you paid an established employee, this falls under the scope of a W-2. On the other hand, if your business employed a contractor and paid in cryptocurrency, you must issue a 1099.

Unsurprisingly, you must report this on your return. According to current crypto tax regulations, you are obligated to treat your crypto income exactly as you would with regular income. As with fiat currency, your federal tax rate will then vary based upon income bracket.

As the gifter of cryptocurrency, gift tax rules apply and gift tax returns may need to be filed. Significant tax planning opportunities exist around gifting cryptocurrency.

As the donor of cryptocurrency, you may be eligible for a tax deduction due to your charitable giving of donations.

Being the emerging market that it is, the tax issues affecting cryptocurrencies are constantly changing.

Most CPAs are pretty old school and have no concept of how blockchain works – and that’s assuming they even understand what it is! And because of that, a lot of money ends up being left on the table. Here are seven of the most common mistakes and misconceptions people have when it comes to crypto and taxes.

I truly feel like Micah is a part of our business and there’s not a doubt in my mind that we could not have done and achieved what we’ve achieved this year and been guided in the right direction without him.

Adley Stump

Micah has almost been an extension to my team. And as I’m looking at even more advanced financial ventures he’s there as someone that can be on my side as an advisor to help me through that part as well.

Rudy Mawer

If there’s any recommendation that I could give for an accountant in the United States, no matter what type of business that you’re in, it would certainly be Micah Fraim.

Robert Rickey

Most accountants I came across work strictly with brick and mortar businesses. They were completely clueless about internet business.

I found Micah and made one of the smartest decisions I’ve ever made by deciding to work with him.

Justin Willman

I found Micah and all my accounting and bookkeeping problems were solved! I can now concentrate on making money instead of keeping up with it!

Doug Brandt

I can not say enough good things about Micah. He is the only CPA I trust, and has saved me so much money in taxes.

Kristen Rocha

The IRS has drastically changed how crypto cost basis is calculated for 2025 and forward. Since basis is now calculated on a wallet-by-wallet approach, taxpayers

The IRS is no longer allowing taxpayers to use the “universal” wallet approach starting in 2025. This is the method basically every crypto tax software

The IRS has finally issued guidance on staking income. They state that cash-basis taxpayers must report the staking rewards when they have gained full dominion

If you have a general inquiry and would like to speak to our expert team, you can contact us via the below contact form:

Your Privacy is our Policy

Enter your details below & let us know where to send your instant ebook download link...