Update: since we originally posted this article, the crypto market has shifted considerably. Celsius and Voyager have both stopped allowing withdrawals and other exchanges are likely to follow suit. The benefit of earning interest has become completely outstripped by this risk of insolvency. Move all of your assets to cold wallets or risk losing them entirely.

We’ll often get asked which platforms we use for crypto, so a while back we compiled all of our affiliate links into a Google Doc. But this can sometimes lead to more questions than answers as to why we like those platforms, so we wanted to expand on the different situations where these platforms can be best utilized.

To be clear, these are just the platforms we currently use. These are not endorsements and storing your crypto anywhere aside from a cold wallet has its risks. Any crypto platform could be hacked, be a fraud, or otherwise go insolvent. So do your own research before utilizing any exchange or software.

We’ll expand on each exchange below, but in general: Binance, Coinbase, and Voyager are the easiest for onboarding fiat. That is a huge advantage, but they also have significant downsides.

The other platforms mentioned – Celsius, Crypto.com, Kraken, KuCoin, and Nexo – either do not have the ability to onboard fiat or it is more arduous/expensive. But they have other significant advantages that make them worth using.

Binance.US

Binance Offer: Possibly lower trading fees? Benefit unspecified

Binance.US is probably the lowest cost platform for initially purchasing crypto with a fiat currency. The spread is more favorable to alternatives like Coinbase and Voyager, but like those two exchanges it can immediately pull funds from your bank account. This allows you to complete a trade on Binance with no delay – although you do have to wait 10 days for the ACH to fully clear before you can transfer your tokens to another platform.

It also allows staking on a handful of tokens, although it does not allow for P2P lending and also does not give interest on deposits the way that Crypto.com and other platforms on this list do.

The one big thing to note with Binance.US is that it is not the same as Binance.com. Due to regulatory issues in the US, the functionality of Binance.US is much more limited than the regular Binance website. For instance, you are unable to purchase Binance Smart Chain tokens on it, despite BEP-20 of course being a Binance product.

Bittrex

Bittrex Offer: Possibly lower trading fees? Benefit unspecified

Bittrex we are mentioning solely in case anyone is searching for it by name and to make it clear that it was not excluded unintentionally.

Bittrex is a perfectly functional exchange and seems to verify your initial signup faster than some other exchanges. But it does not allow staking, P2P lending, or interest on deposits like other platforms do. So, we rarely use it.

BlockFi

BlockFi Offer: $10 after $100 deposit

I’m generally pretty neutral on BlockFi. Similar to Coinbase and Gemini, it is easy to use but has higher fees and lower rewards rates than other platforms.

The one thing that is very interesting about BlockFi is that they have come out with the first crypto credit card. Other cards – including Crypto.com’s and Coinbase’s – are prepaid debit cards, not credit cards.

BlockFi allows you to use an actual credit card (with all of the protections that come from that vs. a debit card) while earning 1.5% cashback in BTC. So while we’re not a huge fan of the rest of their platform, we absolutely are of their card.

Celsius

Celsius Offer: $50 after your initial $400 deposit

UPDATE/WARNING: Celsius froze withdrawals on 06/16/2022. If the platform even survives, this is a major concern.

Celsius does not offer the highest baseline interest rates, but they do offer better promos than probably any other platform. The current signup bonus is $50 in BTC after your first $400 deposit, which is higher than any other platform on the list.

But more importantly, they offer promos for existing users. A few months ago they had a promo for an additional $50 in BTC for a $200 USDC/USDT deposit. They also have a promo for $40 in ADA with a $400 ADA deposit and $40 in BNB for a $400 BNB deposit. You won’t find anything close to that on any other platform.

Celsius also allows you to earn a higher interest rate if you receive your rewards in the CEL token, although this is not currently available in the US.

Coinbase

Coinbase Offer: $10 after your initial $100 purchase

Coinbase is the easiest platform to use by a pretty wide margin. It has a more user-friendly UI, is easy and fast to create an account, and funding purchases from your bank account is immediate and seamless.

It is also one of the most trustworthy companies. It’s a publicly traded company, which gives it more resources for security as well as incentive to keep users happy. We saw this in October 2021 when they refunded the wallets of over 6,000 customers who had been hacked. Very few other exchanges would do that.

With that being said, all of this comes with a price. Coinbase fees are much higher than other exchanges. And their interest rates are much lower. As an example, they recently increased their rewards on USDC from 0.15% to 1%. Other exchanges pay between 8-12%.

Coinbase Pro

If you like the security and reputation of Coinbase but want to reduce the fees, you could move over to Coinbase Pro. Coinbase Pro has lower fees than Coinbase, although you do compromise some of the user friendliness.

We don’t use Coinbase Pro much. It doesn’t allow for staking or P2P lending and still has higher fees than KuCoin and other alternatives. But it does give you some of the perks of Coinbase while significantly reducing the costs.

Crypto.com

Crypto.com Offer: $25 after your initial $400 purchase

Crypto.com is one of the most interesting platforms out there. On pure trading we still prefer KuCoin, but Crypto.com is probably our favorite “all around” choice for a few reasons:

- Free fiat onboarding if you ACH it from your bank account. The only downside is that this takes a few days to hit your Crypto.com account

- Wide range of tokens you are able to purchase and earn interest on

- High interest rates on token deposits

- Lower fees than Coinbase and Voyager

- Metal VISA cards with high cashback rewards and other perks

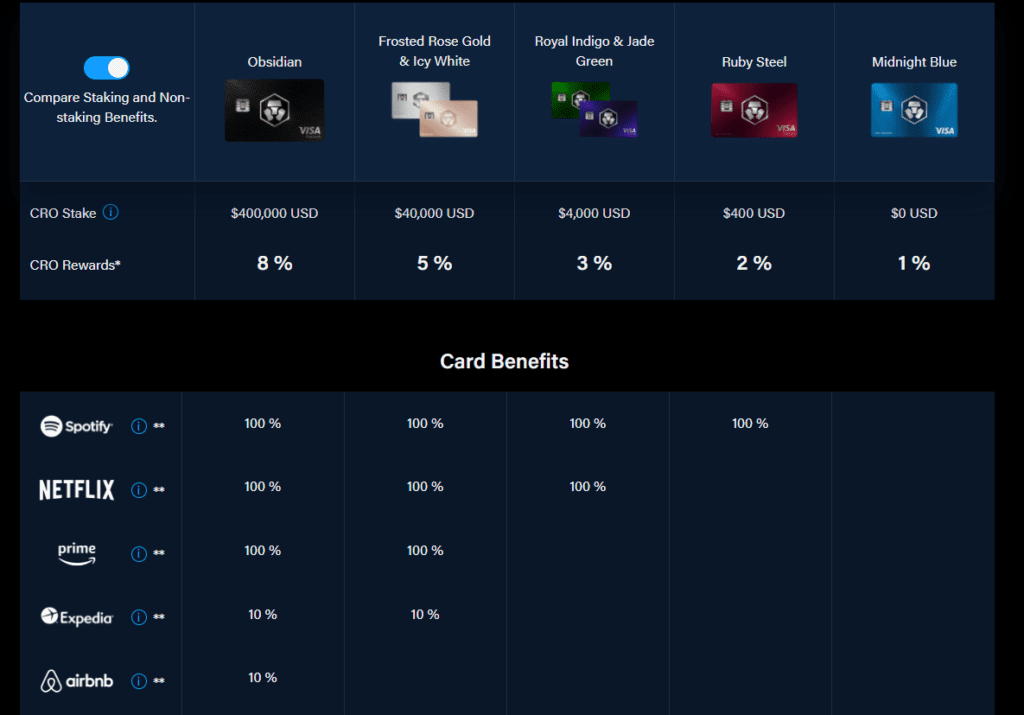

Their VISA cards are probably the most unique thing about them. They are tiered based on the amount of CRO (native Crypto.com token) that you have staked. At $400 you qualify for 2% cashback on purchases. If you had an obscene $400,000 staked, you’d qualify for 8% cashback. This is in addition to perks like rebates on your Spotify, Netflix, and Amazon Prime.

Gemini

Gemini Offer: $10 after your initial $100 purchase

We’re including Gemini in this list in case anyone is searching for it, but it is not a platform we currently use. Gemini notes that “For your security, we require a verifying deposit from this account in order to enable withdrawals to the account.” Unfortunately, that verifying deposit has to be a wire transfer. Given the costs associated with wires and the low interest rates Gemini offers on a limited number of tokens – essentially there being all-around better alternatives out there on other exchanges – this is not something we have chosen to do.

Kraken

Kraken Offer: Possibly lower trading fees? Benefit unspecified

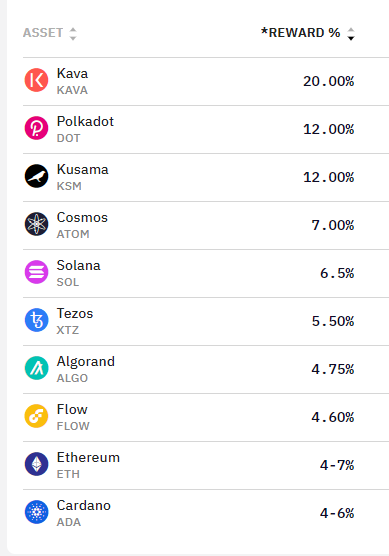

Kraken is an exchange with a lot of different trading pairs and relatively low fees. But what really sets it apart is its staking. Kraken allows users to stake about 10 different tokens very easily – each earning between 4-20% interest.

The ease factor here should not be discounted. As you can see on platforms like Staking Rewards, there are a lot of PoS tokens with high rewards available, but the difficulty level on some of them can be prohibitive. Kraken makes it easy, secure, and also seems to vet these projects before adding them to the platform – so the tokens generally seem to perform pretty well.

You will probably need to purchase the assets on another exchange first, however. The only way to get fiat onto Kraken is via a wire transfer.

KuCoin

KuCoin Offer: “Free gift” after you sign up

KuCoin is our favorite pure exchange. The trading fees are low, and they offer a much wider selection of tokens to trade compared to almost every other platform on this list. Unless you are looking for new altcoins (like you would find on PancakeSwap), it is likely that you will find the token you are looking for on KuCoin.

They also allow staking on a number of tokens.

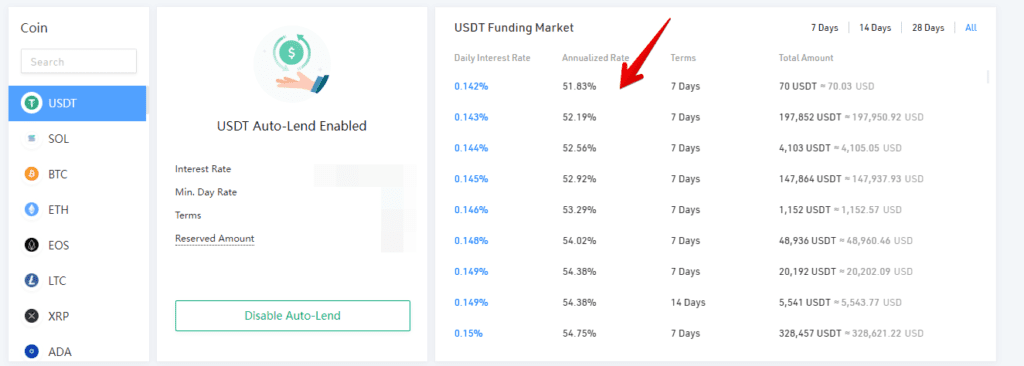

One of the other nice things about KuCoin is that it allows P2P (peer-to-peer) lending of your tokens to other users. These are secured loans taken out for 7, 14, or 28 days from users trading on margin.

In general, centralized exchanges will provide higher and more predictable interest income than these short-term KuCoin loans. For instance, as of writing this article ETH loans on KuCoin are sitting at about 1.5% APR while centralized exchanges are paying closer to 7%.

But there is one major exception to that: USDT. While centralized exchanges will typically pay ~10% interest on USDT, short-term loans on KuCoin can hit anywhere from 30%-60% interest.

Tether is the most common trading pair in the crypto market. Meaning, that if someone is wanting to do a swap for another crypto, the likelihood that it can be traded against USDT is much higher than for any other token.

So what seems to happen is that when people are trading on margin, they borrow Tether since it can be used to trade with almost any token on KuCoin.

When the market is hot, the demand for USDT seems to spike significantly and with it the interest rate.

Given that we’re talking about a >30% interest rate on a stablecoin, there are a few notes of caution that have to be made here:

- Stablecoins are not currency and are not backed by the FDIC like funds in a bank account

- Tether is backed by a private company and could go bankrupt (see #1 above). Tether is an excellent example of this, as it’s currently being investigated for fraud by the NY state attorney general as well as the United States DOJ

- Your KuCoin account or KuCoin on the whole could get hacked and go under and all of your Tether would be lost

There is still significant risk in these loans, like anything crypto-related. If it were risk-free, we’d be liquidating the entirety of our bank accounts and lending USDT out on KuCoin. We’re obviously not doing that. Like any investment, you need to be able to lose the money you invest.

With that said, this is an interesting opportunity if you’re a stablecoin investor.

Nexo

Nexo Offer: $10 after $100 deposit

Nexo is very similar to Celsius:

- High interest rates on deposits

- Ability to earn rewards in their native Nexo token for an additional 2% interest rate (although this is not currently available in the US)

- No way to directly purchase crypto on the platform. You have to purchase it on another exchange and then transfer the tokens to Nexo

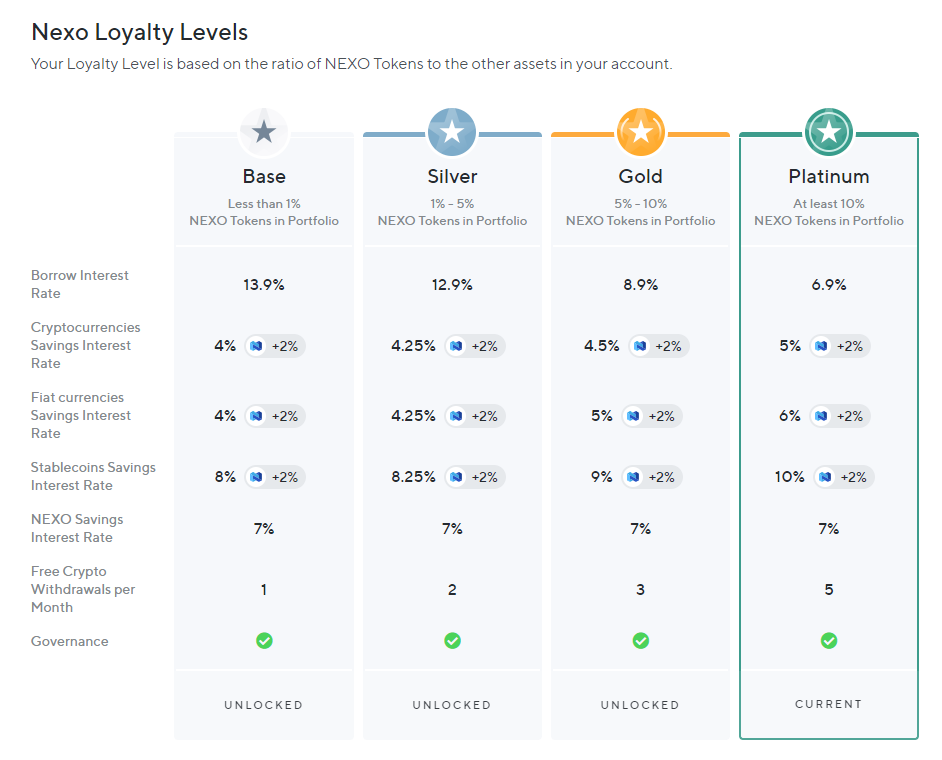

Nexo does not have nearly as attractive promos as Celsius does. For short-term bonuses, I don’t think any exchange beats Celsius. But it does have a few advantages:

- Interest is earned daily, not weekly or monthly like other platforms

- It allows interest on more tokens than almost any other platform. For instance, it is one of the only platforms that allows you to earn interest on XRP

- It has a loyalty program that gives you better interest rates if you hold a certain percentage of your portfolio in Nexo tokens

If they ever allow you to purchase tokens on the platform from fiat and to earn your interest in Nexo tokens in the US, Nexo will probably become my favorite platform.

Voyager

Voyager Offer: $25 after $100 deposit

UPDATE/WARNING: Voyager froze withdrawals on 07/01/2022 and declared bankruptcy on 07/06/2022.

Voyager is one of the easiest platforms to onboard fiat currency to – tied with Binance.US and second only to Coinbase.

It’s really easy to use, offers nearly instant deposits, and gives you interest on a lot of your crypto deposits. But it has more hidden fees than probably any other platform.

First, while Voyager will show “no fee” when you’re trading crypto with them, this is deceptive. While they do not take an explicit fee, the spread on purchase is much wider than other platforms. As an experiment, plug in an equal USD purchase on Coinbase (which is notorious for its high fees) and Voyager. While Voyager will not have any explicit fee stated (vs. Coinbase which will), the amount of crypto you receive will be nearly the same. They do this by having a wider bid/ask than other platforms.

Second, Voyager has very high withdrawal fees. They used to have this publicly posted but removed it a few months ago. This fee is a flat amount regardless of the amount being withdrawn, which can get expensive if you are withdrawing with any frequency at all.

That’s not to say Voyager does not have its uses. We most frequently use it for buying Tether and moving it to another platform. For instance, the fees/spread on USDT is lower than on other platforms. Purchasing 10,000 Tether would cost you about $200 in fees on Crypto.com or Coinbase. It will only cost you $15 on Voyager. Even with the ~$20 withdrawal fee to transfer the funds out of Voyager, that is much cheaper than most alternatives.

The third “fee” isn’t strictly a cost, but rather the limitations they put on qualifying for deposit interest. Nexo, Crypto.com, and Celsius all have no minimum deposit (or very small minimum deposits) in order to earn interest. And the interest is paid out daily or weekly.

Voyager:

- Has pretty high minimum deposits to earn interest

- Only pays interest out once a month

- Your eligibility is based on your monthly average deposit

That third bullet is the one that can get you. In order to earn interest in ETH, you need a minimum average deposit of 0.5 ETH – about $2,300 as of the time of writing this article.

That’s not an inconsequential amount. But if you deposit 0.5 ETH into your Voyager account in the middle of the month, you will not receive any interest. Because for the first half of that month your average was 0.0 ETH – so at the end of your month your average will be 0.25 ETH/below that minimum threshold.

Items like that can make it to where it feels like Voyager is nickel and diming you and is one of the reasons we don’t regularly use it.

But again, for Tether specifically and moving it out of Voyager/to another exchange, it can actually work quite well.

Bottom Line

Everything in crypto has risk – including the platforms. DYOR and keep up to date with changes on different exchanges to see which ones work best for you.

Any accounting, business, or tax advice contained in this communication, including attachments and enclosures, is not intended as a thorough, in-depth analysis of specific issues, nor a substitute for a formal opinion, nor is it sufficient to avoid tax-related penalties.